Whether you want to remodel your house, or buy a new computer to help you get some extra income, a personal loan is a great way to ensure that you can get what you want without too much hassle. Generally, a these are pretty easy to get. They are quick to process, and you won’t have to run around for days trying to get them approved.

In today’s world, getting a personal loan has become a super-simple matter. You can apply for personal loans online, bringing the whole process right to your fingertips.

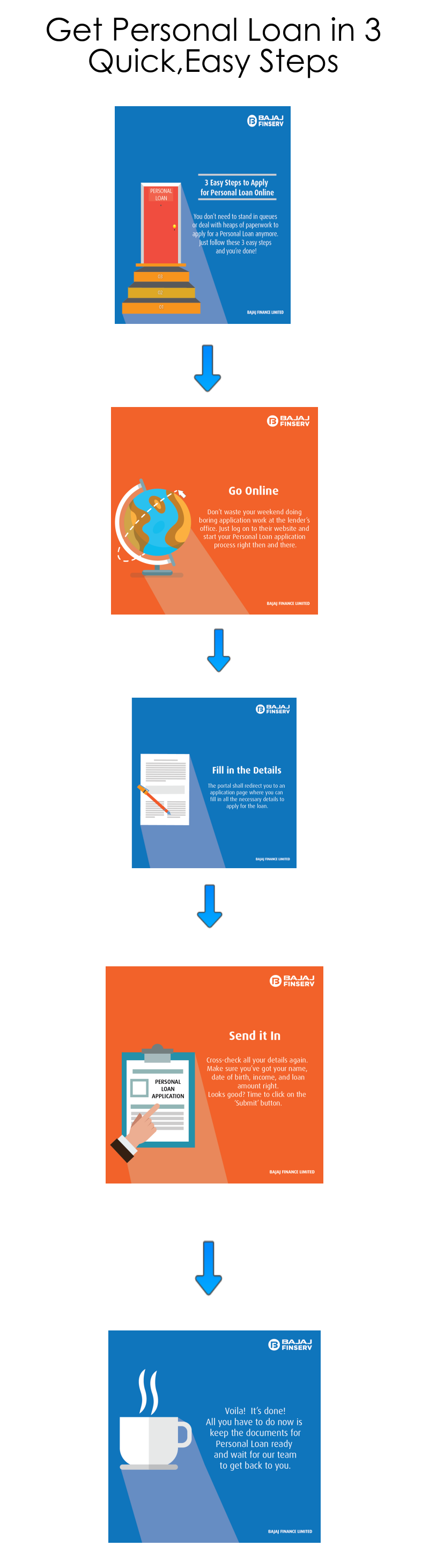

How to Apply for Bajaj Finserv Personal Loans Online?

All you have to do is go to the lender of your choice and fill out a form on the website. This is a small step, which will hardly take you 5 minutes.

After you complete filling out the form, a representative from the lender’s side will call you so they can set up a time to collect the necessary documents from you for the loan.

Once that’s done, your loan amount is generally disbursed to you, within a few days at most.

Advantages of Personal Loans:

Personal loans are pretty nifty for a number of reasons.

They’re readily available, so if you need a small sum of money quickly, they’re the perfect choice.

In most cases, personal loans don’t even require a collateral for you to get approved. This makes it even easier for the borrower, since you don’t have to pledge anything as a security.

The money you get from personal loans is pretty flexible, and can be used for a number of reasons, from paying off your credit card bills, to help pay for a wedding. This isn’t usually the case when you’re applying for other loans, which won’t give you the same freedom.

The sum you can borrow from personal loans ranges from Rs.15,000 to Rs.10 lakh. This can help you decide how much you actually need for what you’re going to spend.

But with all of this, you will have to remember that there are monthly debt obligations.

What are Monthly Debt Obligations?

A monthly debt obligation is the cumulative sum of all the debt that you have for that particular month. If you are currently paying off a home or car loan, then you will also have to add a personal loan into that calculation.

This is something that you should be aware of, since this can actually creep up behind you without you noticing it.

A sure way of keeping this secure is to ensure that you have everything calculated by using personal loan emi calculator, and paid off regularly, so that you don’t default on any of the payments. This keeps your credit score clean and your lenders happy.

What is Financial Obligation?

To put it simply, a financial obligation is the estimate of the ratio between the debt payments you have to pay, to the disposable income that you have on hand.

Ideally, you want to make sure that your debt ratio is lower than your disposable income ratio. This can help you not only pay off all the monthly payments, but also ensure that you can have a little bit of money left over every month for savings.

Personal loans can be pretty handy in a tight pinch, but it’s also important to remember that they’re not there for everything. So, if you’re thinking of applying for a unsecured personal loan, then weigh the pros and cons of your predicted purchase, and ensure that you don’t get into bad credit because of this.

- business

- business loan

- chartered accountant loan

- chartered accountant loan

- Dental practice Loans

- Engineer Loan

- Engineer Loan

- Government Scheme

- GST

- Home Loan

- Insurance for Doctors

- Investment

- Loan

- loan against policy

- loan against policy

- loan against shares

- Medical equipment loan

- Medical practice

- merchant financing

- Personal Loan

- School Funding

- secured loans

- Securities

- Supply chain management

- TAN Number